This piece is available in Mongolian here.

Governments of mining countries are vulnerable to investors using double tax agreements (DTAs) as a means of avoiding paying taxes. DTAs are bilateral, or multilateral agreements between countries that set out which country has the right to collect tax on different types of income. Interest expense on foreign loans is one such source of income. The DTA will specify how much tax the source country can collect on the interest paid by the local mining subsidiary, to its affiliate, usually in a lower tax jurisdiction. In most cases, the tax on interest expense (“withholding tax”) will be less under the DTA than domestic law, thus increasing the risk that investors use DTAs as a means of reducing their overall tax bill.

In a report issued by the Centre for Research on Multinational Corporations (SOMO) in February, Rio Tinto was accused of “illegitimately lowering” its withholding taxes paid to the government of Mongolia in relation to the Oyu Tolgoi copper mine. Rio allegedly did this by using a DTA between Mongolia and the Netherlands, in addition to which it negotiated an even lower rate of withholding tax (WHT) in its amended mining agreement in 2011. This article reviews Rio’s tax arrangements, and concludes that although the concession had a material impact on government revenues, it would be an exaggeration to claim that that Rio avoided WHT on interest on shareholder loans, and there is no clear evidence of excessive interest deductions to support the suspicions of treaty abuse.

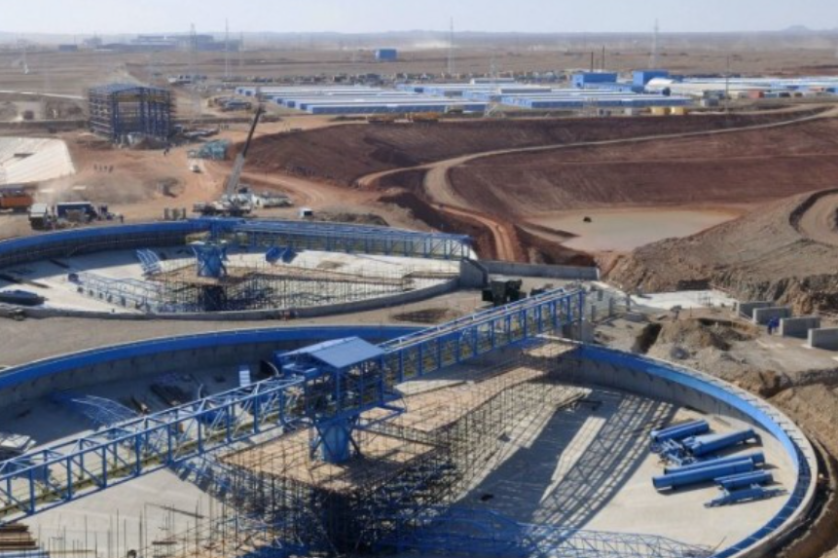

Located in the Southern Gobi region of Mongolia, Oyu Tolgoi is one of the world’s largest copper and gold deposits. The Oyu Tolgoi mine (OT) is jointly owned by the government of Mongolia (34%), and Turquoise Hill Resources (66%). The latter is a Canadian subsidiary of Rio Tinto (51%) listed on the Toronto and New York Stock Exchanges. The OT project combines an open pit and an underground mine producing copper concentrate, which is then transported by rail to China for processing.

Since OT began in 2010, construction of the mine has cost $11 billion in capital expenditure. Phase 1 was the construction of the open pit mine, which was financed by shareholder debt from Rio Tinto, and Phase 2 is the construction of the underground mine, which is being funded by external project finance. From the outset, Rio Tinto has “carried” the government of Mongolia’s (GoM) 34% equity interest in OT, meaning it pays the GoM’s upfront financial contribution, which will be paid back via the GoM’s share of dividends.

In a report issued by the Centre for Research on Multinational Corporations (SOMO) in February, Rio Tinto was accused of minimizing its tax obligations in Mongolia by 1) “illegitimately lowering” its withholding taxes (WHT) on interest paid on foreign loans by $232 million; and 2) financing its Mongolian subsidiary via loans routed through entities in the Netherlands and Luxembourg, which offer DTAs with Mongolia, as well as lower tax rates. The report also alleges that in addition to the WHT issues in Mongolia, Rio skipped out on $559 million in corporate income tax in Canada – this issue won’t be considered here.

Though an evaluation of the deal is beyond the scope of this piece, and would necessarily start from detailed modelling of all revenues throughout the life of the mine, such as done by OpenOil, there are important policy lessons to draw from this case, and the revenues collected so far.

WHT requires the taxpayer to withhold some income tax on payments made abroad. For example, let’s say a taxpayer in Country A borrows $1000 from a lender in Country B. The lender requires 10% interest on the loan, which is $100. The WHT rate in Country A is 5%, meaning the borrower must withhold $5 WHT on the $100 interest it pays to the lender. WHT is usually levied on service charges, shareholder dividends, and interest expense on foreign loans. We focus on the last category.

WHT on interest is important for three reasons. First, it can be a significant source of revenue for governments, particularly given the level of capital investment, and hence financing, required in the mining sector. Secondly, it is comparatively easy to collect, which is critical in countries with weak tax administration. Finally, and perhaps most importantly, WHT is a safeguard against tax base erosion and profit shifting (BEPS).

The implications of the $232 million foregone in WHT will be discussed in light of these reasons:

a) Significance of the WHT concession

Between 2011 and 2015, Rio took advantage of a lower rate of WHT in a Double Tax Agreement (DTA) between the GoM and the Netherlands. Amongst other tax concessions, the treaty stipulated a WHT rate of 10% on interest, reduced from 20% in Mongolian law. The result was what SOMO estimates to be $173 million in forgone tax revenue so far (i.e. the difference between 20% and 10% WHT). Rio Tinto’s own taxes paid reports show, that despite its lowered rate, WHT on interest has been a major source of early revenues, providing, for example, more than a third of the $149 million in total taxes paid in 2016 to the Government of Mongolia. OpenOil’s financial model estimates that a lower rate (a reduction from 20% to 10% on Rio’s share) of WHT on interest will cost the GoM $700 million in potential tax revenue over life-of-mine.

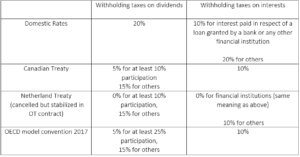

While the lower rate of WHT on interest payments has had a material impact on GoM revenues, it does not seem that Rio Tinto specifically structured the deal in a way to benefit from a lower WHT per the DTA with the Netherlands. In the period reviewed by SOMO, 100% of OT’s debt was funded by shareholder loans, which attracts a rate of 10% WHT under the Netherlands DTA. This rate is equal to the rate Mongolia has in tax treaties with a range of countries, including in Canada (see Table 1 below), so Rio did not need to “treaty shop” for this particular benefit. Furthermore, the rate is also consistent with global treaty practice (Art.11 of the OECD Model Convention), and the International Monetary Fund (IMF) had pointed out the potential risk to revenue in 2008, a year before the GoM signed the Investment Agreement with Rio Tinto, therefore the GoM should have been aware of it.

However, one aspect of the Netherlands DTA that is unique, and could give rise to claims of treaty shopping, is the lower rate of 0% WHT for interest paid on loans from financial institutions. The WHT distinction between financial institutions, and other lenders, creates a risk of “back-to-back loans” whereby a third party (e.g., a foreign bank) is interposed between two related taxpayers (such as a foreign parent corporation and its subsidiary) to avoid the higher rate of WHT that would apply if a loan were made directly between the two taxpayers. As far as we know, Rio has not availed itself of this opportunity. The $4.4 billion project financing agreement for phase 2, which is funded by a mix of international financial institutions, export credit agencies, and commercial banks, is directly with the OT Mongolian subsidiary, and consequently, the Dutch treaty does not apply. Notwithstanding, the GoM should closely monitor any future bank loans originating from the Netherlands.

Another grave concern, raised, but not discussed in detail by SOMO, is that the Dutch treaty also lowered the WHT on dividends to zero, which is below the rates seen in Mongolia’s other treaties, as well as the OECD Model Convention. This may have an important impact on future revenues though it needs to be assessed in light of the deal as a whole.

Table 1. Withholding taxes on interests and dividends

Source: Domestic rates, Canadian Treaty rates, Dutch Treaty rates, OECD convention rates

Recognising the risk to revenue, the GoM annulled the Dutch treaty in 2014. However, the lower rate continued to apply because of the fiscal stabilization provisions in Rio’s Investment Agreement. Fiscal stabilisation assurances are where government commits to either partially or completely fix the fiscal regime. This is to avoid a situation, where governments offer favorable terms, but reverse them as soon as investment is completed. Though it is best practice to limit the duration and scope of stabilization provisions, it is not uncommon to fix key tax terms for such large deals in the mining sector, especially in uncertain legal and political environments. The Investment Agreement is carefully drafted to include Mongolia’s Double Tax Agreements in the stabilization mechanism.

b) Tax Administration: not all taxes are created equal

WHT on interest is relatively easy to collect, and therefore less likely to involve significant financial and human resources, or result in taxpayer disputes. This is particularly important given Rio’s complex corporate structure and funding arrangements for the mine have been a source of tension for many years. GoM issued Rio a $130 million tax claim in 2015, which was later reduced to $31 million after discussion at the Dispute Resolution Council of the Mongolian Tax Authority. Earlier this year, the GoM issued a $155 million tax claim against Rio – an extensive audit is expected to follow. Both cases demonstrate some of the difficulties in collecting various other taxes.

Despite WHT on interest being an easy tax to levy, SOMO revealed a newer WHT concession, which, it alleges, further reduces GoM revenues by $59 million. The concession relates to Rio using an even lower rate of WHT on interest, 6.6%. The basis for the lower rate is Article 18(c) of the Amended and Restated Shareholder Agreement (ARSHA) (2011). The Article states that Erdenes OT (the state-owned company that manages GoM’s investment) is responsible for all taxes attributable to its 34% share, including for the repayment of interest on loans obtained from shareholders. Rio and Erdenes OT therefore owe 66% and 34% respectively of the WHT amount for total interest expense on shareholder debt. In practice this meant that Rio was effectively paying a WHT rate of 6.6% (i.e. 10% of 66%) on OT’s total interest expense on shareholder debt. The OT Netherlands 2015 company report (not in the public domain, obtained by SOMO) references a letter from the GoM, which confirms this assessment.

While it seems reasonable that over the long-run Rio Tinto should not have to pay the taxes attributable to the Erdenes OT share of the debt, in the short term, an alternative would have been to pay the 10% WHT, add it to the GoM’s tab for later repayment via dividends, thus leading to higher tax receipts now.

It is important to evaluate the WHT on interest concession against other characteristics of the deal, we don’t do this in detail here, but others have. For example, unlike many other mining countries, in Mongolia, the Value Added Tax (VAT) charged on mining inputs is actually a tax (i.e. non-refundable). Consequently, VAT is an important, and unique, early source of revenue for the GoM. On the other hand, Rio also got an investment tax credit, which means it can offset some of its capital expenditure against its income tax charges. The significance of the reduced WHT rates need to be seen (and modelled) in light of all these other terms, and also taking into account when the deal was done.

c) A safeguard against profit shifting

Companies can finance a mining investment through debt or equity. Debt is treated differently to equity for tax purposes: interest payment on the debt can be deducted from taxable income, reducing a company’s overall tax bill. Consequently, companies have an incentive to increase their leverage (i.e., increase the proportion of debt in their sources of financing), in particular for subsidiaries in high-tax countries. WHT on interest is also a financial barrier to such practices – a ‘last line of defence’.

SOMO is right to be suspicious of the reduced WHT on interest, and Rio’s financing of its Mongolian subsidiary via loans routed through entities in the Netherlands and Luxembourg (countries well known for channelling tax avoidance). Intercompany loans regularly create opportunities for multinational groups to shift profit from high-tax to low-tax jurisdictions via excessive interest deductions (see the recent Chevron case in Australia). However, the critical question is whether the rate paid by the Mongolian subsidiary differs significantly from the other participants.

Luckily, the SOMO report sheds some light on previously unseen financial accounts from the Dutch subsidiary, which we can tentatively analyze. A back of the envelope calculation, suggests that the Rio subsidiaries in Luxembourg, the Netherlands, and Mongolia are all using interest rates of approximately LIBOR +5.5%-5.6%. Had there been large differences between the different subsidiaries this may have been a smoking gun for profit shifting, but the little information we have does not indicate that Rio was stripping profit out of the mine via interest expense. In any event, if the GoM wants to find out if the interest rate the Mongolian subsidiary is paying is reasonable it has two benchmarks – 1) the project finance at LIBOR +6% (bearing in mind this rate is likely to have been ‘grossed up’ somewhat to account for the WHT payable by the international banking syndicate), and 2) the 2015 financing and guarantees obtained from the International Finance Corporation.

While Rio’s complex financing structure may not be the culprit, there is another profit shifting risk the SOMO report does not address. That is, the management service payments (MSPs), which are 3% of the total capital and operating cost of the mine up pre-production, and 6% thereafter. Management services are where a subsidiary pays a fee to a related party in return for a range of administrative, technical and advisory services. In this case, OT pays Rio Tinto a fee, via its subsidiary in the Netherlands, for providing mining expertise and technical services, procurement and logistics, risk and compliance, commercial services and human resources services. The ‘mischief’ is the way the fee is calculated based on the total capital and operating cost of the mine, rather than the actual cost of providing the service, plus a small mark-up, as recommended by the OECD Base Erosion and Profit Shifting (BEPS) project Action Items 8-10.

The argument against using “cost-plus” is the time and effort it would take Rio to accurately allocate costs, and the Mongolian Tax Authority to verify. That may be so, but arguably a more prudent route would have been for Rio to request an advanced tax ruling to agree on the cost allocation method, and mark-up. Rio has shown willingness to enter similar agreements in Australia, Canada, and Singapore, albeit via Advance Pricing Agreements, which are legally binding.

OpenOil estimates that MSPs add up to $2.9bn in real terms in Rio’s 2014 Technical Report. The planned $5.3 billion expansion of OT will swell MSPs even further, significantly reducing the Mongolian subsidiary’s taxable income, and further deferring the GoM’s dividends. Ideally, Rio and the GoM would agree an alternative way to calculate MSPs that better reflects the cost of the service, and set a limit on MSPs relative to total costs.

Conclusion

SOMO uncovered important new information from company fillings of the OT project. The lack of clarity on applicable WHT rates is a cause for concern; therefore, it would be beneficial if GoM and OT produced a joint communique on which WHT rates apply for the shareholder loan, the project finance loan, and future dividends. However, it would be an exaggeration to conclude that Rio avoided WHT on interest on shareholder loans, and there is no clear evidence of excessive interest deductions to support the claims of treaty abuse. Nevertheless, moving forward, the 0% rate of WHT in the stabilized Dutch treaty on bank loan interests and dividends, more favourable than other DTAs, may be an issue.

The revealed costs in early and easily collectable WHT revenues provide an important lesson on the dangers of (stabilized) tax treaties. But, it is critical that any tax concession and dispute are viewed in context against the deal as-a-whole, looking at both the costs and the benefits that flow from the mine.