From Wall Street to the World Bank, people are looking at Kampala as a model for how cities can finance their futures.

This piece first appeared on Next City.

Joseph Aliguma is perched on the bull bars of a minibus, listing his expenses. Every day he drives his 14-seater “taxi” between Kibale, in western Uganda, and the capital Kampala, rising as early as four and sometimes not resting until 11 at night. There are loading fees, he says. Add to that insurance, petrol, engine oil, filters. And then there is the fee — 120,000 shillings ($36 U.S.) a month — that he must pay to the city authority. It’s too high, he thinks, but ordinary people like him have no power to change things. “It’s not our country, so we have to pay.”

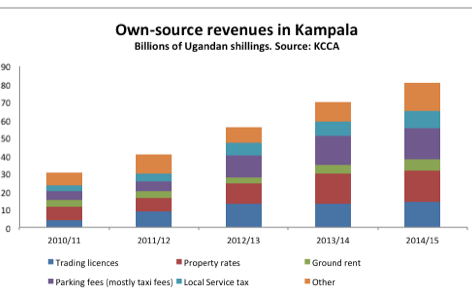

Kampala is a city in upheaval, and Joseph’s resignation is one sign of change. It is five years since the creation of the Kampala Capital City Authority (KCCA), a new executive body charged with improving services in the city. One of its first priorities was to overhaul tax collection. Revenues have soared from Sh30 billion ($9 million U.S.) in 2010/11 to Sh81 billion ($24 million U.S.) last year, a rise of 89 percent after inflation.

“It’s a significant achievement,” says Roland White, global lead for city management, governance and financing at the World Bank. “I’m just not aware of any other big African city which has done what Kampala has done in proportional terms.”

He is not alone in his enthusiasm. The World Bank is pouring money into the city for road and drainage projects. KCCA officials are regular speakers at international conferences. Last year Global Credit Ratings, a South African agency, gave Kampala an “A” rating for its long-term debt, which could pave the way for a municipal bond issue. There is some way to go yet, but if a bond materializes it would be a first for Uganda, and a rare sight in Africa more generally: a symbol that Kampala has got its finances in order and is open for investment.

But for all the plaudits, much of that extra revenue has been squeezed from people like Joseph — taxi drivers and small businesses, who are struggling to get by. Many Kampalans feel disempowered by reform. The KCCA’s powerful executive director is appointed directly by the president, and overseen by a Minister for Kampala in cabinet. While the authority’s technocratic vim excites international experts, it alienates the locals. “The KCCA doesn’t listen,” says Naswif Kiggundu, a trader. “They do each and every thing from the top.”

If this is a local story, it carries lessons for a continent. African cities will triple in size by 2050. Greater connectivity and economies of scale could unleash a “miracle of productivity,” in the words of Paul Collier, a development economist. For that to happen, all those extra people will need places to live and ways to get around. The World Bank puts sub-Saharan Africa’s infrastructure needs at $93 billion U.S. a year, much of it in cities. Services, too, will need funding. Africa is urbanizing at a lower level of income than other parts of the world. The money will have to come from somewhere.

New construction is constantly popping up along Kampala’s main road.

New construction is constantly popping up along Kampala’s main road.

The obvious place is from cities themselves. “Local financial sources will be the future for urban development,” says Ananda Weliwita, an economist at UN-Habitat. “There’s no other choice.” Government negotiators and policy wonks from around the world are meeting this weekin Surabaya, Indonesia, to polish the draft of a “New Urban Agenda”; the final declaration will be unveiled at theUN-Habitat III conference in Quito this October, shaping conversations for the next 20 years. Preliminary discussions envisage local finance as one three planks of change, alongside regulation and urban design.

Weliwita enthuses about the revenue-raising possibilities for cities. “In many cases they don’t even know that they have this potential,” he says. That potential must be realized in living cities, not in a conference hall. Kampala, with all its contentions and compromises, is as good a place as any to start.

A CULTURE OF RESISTANCE

Like Rome or San Francisco, Kampala was built on seven hills: a small colonial centre on one peak, with the palace of the Buganda king on another. Today, it slouches across 24, a low-rise sprawl that stretches to the shores of Lake Victoria. The resident population of 1.8 million swells to 4.5 million during the day, and is growing at 4 percent a year.

The city has an unruly reputation, bound up with its youthful demographics and strong local identity. “A culture of resistance has become part and parcel of what Kampala is,” says Nansozi Muwanga, head of politics at Makerere University. In the past the government starved the city of funds as retaliation for its stubbornly oppositionist leanings. The pre-reform city council, for its part, was notorious for crooked contracts and crumbling services: In one protest, grumpy residents pretended to catch fish from flooded potholes.

The creation of the KCCA was meant to change all that. In the official story, the authority was designed to transform the city, under committed, experienced leadership — a narrative that easily meshed with the institutional reform agenda pushed by agencies like the World Bank. The more cynical view sees it as a power-grab by Uganda’s authoritarian president, Yoweri Museveni, trampling on local democracy to stamp his will on the capital.

Whatever the truth of the politics, the finances didn’t lie. When the KCCA took over, the city operated 151 bank accounts. Suppliers were rarely paid on time. Revenue collection was farmed out to grafting middlemen, with many taxes never making it to the public purse. “Nothing was working,” says Patrick Musoke, the KCCA’s director of strategy, “and most of the good contractors had given way because of the massive corruption.”

Many of the KCCA’s new officials came from the national tax authority. They soon set about the unglamorous work of rejigging the city’s systems. The spider’s web of accounts was consolidated into eight, overseen by the central bank. Staff were given more computers — it had been one for every five officials — and databases were digitized. An automated system, dubbed “eCitie,” allowed citizens to pay taxes through their phones. Streamlining tax registration, in partnership with national authorities, brought 110,000 informal businesses into the tax net.

Kampala still doesn’t pay for itself. That is hardly unusual: Local taxes and charges often amount to less than a 10th of African cities’ revenues, says Mihaly Kopanyi, a consultant, with central government and development agencies making up the shortfall.

But thanks to the reforms Kampala now generates a third of its own income. There is plenty that can be taxed locally; after all, the city accounts for 60 percent of Uganda’s GDP. “If everything goes to plan,” says Sam Sserunkuuma, KCCA director of revenue collection, “then the city will be self-sustaining in the next seven to 10 years.” That sounds optimistic, but is suggestive of the KCCA’s ambition.

The KCCA has brought more visible changes too. “It has organized the streets, and we have cleanliness,” says Aaron Aojaar, a banker, waiting for a new commuter train service, which has been running since December. People should get behind the new authority, he says: “It takes time to transform a third world town.”

That is a common sentiment among the middle-classes. But in the clamour of downtown Kampala, where reform has been most intensely felt, Aaron’s optimism is not widely shared.

UNEQUAL BURDENS

Kampala is a divided city: It was meant to be that way. Fearing malaria, British administrators decreed the segregation of the town into European, African and Asiatic zones. That was hard to enforce, but custom and land prices did the job anyway. A revolted town planner, writing in 1931, described Kampala as “a strange mixture of the delightful and the hideous”: The “splendid hillsides” of the rich and the “death-dealing swamp” of the valleys, where the poor clustered in makeshift shacks.

Colonialism is gone. The protective “green belt” around the European settlement is now a golf course. But social class is still mapped upon the steep contours of the city. On Nakasero hill, crisply dressed professionals stroll between banks, embassies and government buildings. Yet stumble down the sloping streets and you drop into another city entirely. Motorbikes curdle the traffic flow. Hawkers flog secondhand clothes. Shopkeepers trade their wares in labyrinthine plazas, constructed like honeycomb above congested streets.

At the center of it all, in the hollow of the hillside, is the Old Taxi Park: a “seething, kidney-shaped bowl,” as Ugandan novelist Moses Isegawa puts it in his Abyssinian Chronicles. Four-fifths of motor journeys in Kampala use minibus taxis, and many of those journeys end here. Viewed from above, the taxi park is a mosaic of glinting roofs — a natural amphitheatre where the first scenes of reform were played out.

The park used to be managed by the Uganda Taxi Operators and Drivers Association, a thuggish clique masquerading as an industry body. It had a contract to remit Sh392 million ($120,000 U.S.) to the council each month, but extorted several times that amount from helpless drivers.

One of the first acts of the new KCCA was to cancel the contract, bringing tax collection back in-house. Revenue from taxis doubled in a year. So-called “road user fees” (which also include car parking) are now the second-largest source of revenue, accounting for a fifth of last year’s total.

Drivers had no affection for the old regime, but found little to love in the new one. Though fees did not rise, the new monthly rate did not take account of days when vehicles were off the road for repairs. Drivers also complained about the KCCA’s methods: impounding taxis and, some allege, turning a blind eye to the heavy-handedness of its enforcers.

The KCCA was soon dragged into the fraught politics of the taxi parks. Rival taxi associations jostled for influence, at times violently. Some drivers refused to pay the monthly fee, organizing sit-down strikes and challenging the levy in court. When a radical faction held elections in 2014 the KCCA refused to recognize the result, backing an alternative, more compliant grouping. “We agreed to pay the fee because there is no escape route, but it is too high” says Mustafa Mayambala, winner of that unofficial vote.

It is not just the taxi drivers who feel they are shouldering the fiscal burden. Kampala’s second fastest-growing source of revenue is trading licenses. The rates are set by central government, and vary with business type and location: A city center shop, for example, pays Sh210,000 ($65 U.S.) a year. Charity Nanono, who runs a stall selling children’s shoes, thinks that small vendors like her are unfairly put upon. “After you pay rent, electricity, food and transport, what you get in profit is very little.” Others wonder where the money goes, and why they still have to pay extra charges for garbage collection and public toilets.

Shoppers pass a newly constructed mall in the heart of the Central District of Kampala.

Shoppers pass a newly constructed mall in the heart of the Central District of Kampala.

The avatar of this bubbling discontent is Erias Lukwago, a populist lawyer who was elected as Lord Mayor in 2011. He demanded a tax refund for traders, refused to approve the taxi fee and was arrested while protesting the eviction of vendors from one of the taxi parks. His posturing predictably irked the KCCA’s executive director, Jennifer Musisi, a hard-nosed technocrat dubbed the “iron lady’” by local press.

Two years into his term, Lukwago was impeached for “abuse of office” (the ruling specifically cited his resistance over licenses). It did his reputation no harm. This year he was handsomely re-elected with 75 percent of the vote — after launching his campaign, tellingly, at the Old Taxi Park.

“He’s our mayor, not their mayor,” says one driver, who didn’t want to be named. In part, Lukwago owes his popularity to national politics: He has promised to “dismantle the dictatorship” of Uganda’s long-time president, Yoweri Museveni, who is widely loathed in Kampala. But he also articulates a radical notion of accountability, which directly challenges the KCCA’s appointed officials.

The biggest complaint against the KCCA is not what they do, but how they do it. “They think that it is the state which hired them,” says Moses Kalule of the Kampala City Traders Association, which represents small businesses. “But remember we contribute money. It is our city, our roads.”

Opposition protests are quenched with tear gas. Plans to redevelop markets, ban street vendors and register boda bodas (motorbike taxis) have all met resistance. When it comes to revenue collection, the KCCA’s approach to enforcement is seen as arbitrary and unforgiving — a “witch hunt,” in the words of Kennedy Okello, a newly elected councilor.

KCCA officials deny any unfairness. “I don’t see why someone who is upright fears the regulations,” says Sam Sserunkuuma, director of revenue collection. The traders and taxi drivers do not own the city, he adds, listing the services from street cleaning to hospitals that their fees help to fund. “Accountability to the people is in the provision of services. We cannot call everybody to a rally.”

Back in the Old Taxi Park, some drivers have come to accept the Sh120,000 ($36 U.S.) fee. Others still say it is too high: They have bosses to pay, as well as expenses, and after the levy the typical driver takes home Sh15,000 ($4.50 U.S.) a day. They have seen little of the services which KCCA officials promise. The city’s wage bill has soared since the KCCA took over, gobbling up most of the extra revenue.

Ask about fairness, and taxi drivers scuff their feet on the ground. “The fees would be fair,” says one, “if only it wasn’t so dusty here.”

WHERE THE STREETS HAVE NO NAME

There is no dust at Acacia Mall. Its marble floors are spotless. A fashionable crowd, both Ugandans and Westerners, glide around its colonnades. The glitzy development opened two years ago in the wealthy suburb of Kololo, marketed at the urban elite. There’s only one problem: Like anything else built in the last seven years, it pays not a shilling of property tax.

For Kampala, an effective property tax is the Holy Grail. “It should be the main revenue source,” says Sam Sserunkuuma, KCCA director of revenue collection: He reckons the city could triple the amount it currently collects.

But tax officials are groping in the dark. The last property valuation was done in 2005, and revised in 2009. Though rental values have tripled in a decade, none of the gains have reached city coffers. New buildings like Acacia Mall do not officially exist.

Traders sell their merchandise in Kampala’s Central District.

Traders sell their merchandise in Kampala’s Central District.

And that’s just the start. Most of the city’s housing is informal and land ownership is often uncertain. Most streets don’t have names, and houses don’t have numbers. The property register is a confusing jumble.

No wonder that property tax falls far short of potential: though it is the largest source of revenue, it contributes barely more than taxi and parking fees, and has grown at a slower rate. That is a missed opportunity. A tax on property — or, even better, on land — makes sense for cities. It scoops up the windfall gains of lucky landowners, whose properties rise in value as amenities improve. Land and property, unlike income, can’t be hidden: A house, or a shopping mall, can’t be smuggled offshore.

A specific land tax has its own advantages. “It doesn’t tend to distort incentives in the marketplace,” points out George McCarthy, president of the Lincoln Institute of Land Policy, an American think tank. Indeed, a land tax would encourage developers to build up, rather than out, making land use more efficient. McCarthy suggests a range of other mechanisms to capture the value of land, from the sale of development rights to “betterment contributions,” where residents pay a fee to bring improvements like water or sewerage to their area.

Some of these schemes are too complex for Kampala at present. Most of the city is owned under a convoluted system of traditional land tenure, which separates ownership of buildings from ownership of the underlying land. But officials want to make a more standard property tax work. World Bank support is helping the KCCA to compile a database of buildings, using geographic information system (GIS) technology. When the mapping is complete, tax officials plan to apply a rough valuation of each property based on its location — a cheaper alternative to individual assessments.

There is one snag. Owner-occupied houses are exempt from property tax, following a cynical promise by the President during the 2006 elections. They make up 53 percent of all eligible properties, so the resulting losses are huge. Sserunkuuma describes the law as a “headache”: His officials have to traipse around town, verifying how buildings are being used. It also creates loopholes for tax evaders to exploit.

But only central government has the power to scrap the exemption. The KCCA’s best efforts have so far failed to coax a law change from Uganda’s self-interested politicians, who recently passed a bill to exempt themselves from income tax.

“Ask yourself, ‘where do the parliamentarians stay?’” says Patrick Musoke, KCCA director of strategy, pointing to their substantial property holdings in the city. Bernard Luyiga, a former councilor, is blunter. “The ones who have the money control the politics here,” he says.

THE DEVIL IS IN THE DETAILS

The KCCA has its faults, but ambition is not one of them. Consider its ideas for transport: a bus network, light rail and even, perhaps, cable cars to ferry commuters through the sky.

Part of the plan is a new transport hub. Sitting in his office at KCCA headquarters, Musoke gushes about the project. “It’s wonderful idea,” he says of the proposals in a new, 300-page, EU-funded report, which include multi-story parking, shopping and recreational space. And the intended site for this development? Nowhere else, of course, than the dusty Old Taxi Park.

A new mall is being built in the Central District of Kampala.

A new mall is being built in the Central District of Kampala.

But it won’t be paid for out of taxi fees. Even with a meatier property tax, Kampala doesn’t have the resources to fund lots of these chunky investments yet. Many cities will wrestle with similar problems as they strive to fulfill the promises of the New Urban Agenda in areas from housing to sustainability. The solution, Musoke muses, is to look elsewhere: to the private sector, to capital markets and to foreign donors.

Take the transport hub. One idea is to set up a public-private partnership (PPP): a long-term contract with a private company that would build and operate the development, earning revenue from parking fees. A national PPP Act, passed last year, strengthens the legal framework for such arrangements. The city’s strategic plan lists 14 other potential projects, from street lighting to primary schools.

But “the devil is in the details,” Musoke admits. PPPs may work for self-contained schemes with low capital requirements: areas such as solid waste management, in which Kampala has already signed deals with three private companies. For larger projects they are loaded with risk. Contracts are complex and opaque, with private investors demanding high returns of 15-20 percent. If things go wrong, as they often do, the government is left to pick up the pieces. PPPs “should not be considered a panacea,” experts at UN-Habitat warned in a recent policy paper.

That explains the enthusiasm for a municipal bond. It may not happen: City officials have been floating the idea for several years. But receiving an “A” rating last year removed a major obstacle. The next hurdle is national law, which limits the city’s borrowing to 10 percent of its revenues. Should that restriction be relaxed — and Musoke is optimistic that it will — the city plans to issue a project-specific bond for the transport hub, paid off with ring-fenced revenues

Debt carries its own risks. Bonds may be an option for “some of the bigger and better-run cities” in Africa, says Roland White of the World Bank, but he stresses the importance of a clear regulatory framework. In Dakar, Senegal, a planned bond was pulled just two days before the launch date last year, the victim of murky regulation and even murkier politics. Debt will have to be issued in local currency and the pool of potential investors is quite small. In any case, borrowing doesn’t generate revenue: It simply brings forward future income, which will one day have to be paid back.

That leaves donor assistance. Kampala is not short of foreign friends. The World Bank will spend over $200 million in Kampala this decade, mainly to upgrade roads and drainage systems. The money will be paid back over 40 years at concessional rates. Central government has also secured cheap Chinese cash for the planned light railway, which will link Kampala with surrounding districts.

When it comes to large-scale infrastructure, a developing city like Kampala must still abide by an Augustin-esque mantra: Let me be self-sustaining, but not yet. For all that, the thrust of reform is clear. Local revenues will be needed to pay for the day-to-day upkeep of donor-funded projects. In the long-run, as the New Urban Agenda will stress, cities must rely more on their own citizens.

Nobody likes paying taxes. Fees go up overnight, while the services they pay for take time to improve. “There is no magic bullet,” says Ananda Weliwita of UN-Habitat. As Kampala shows, beneath any reform lies the procedural plumbing: reorganizing, negotiating and changing attitudes.

All over Africa, cities puzzle over the same conundrums. Rwanda has a new electronic land register, which could help with taxation. Several Tanzanian cities have plumped up their revenues through canny administrative reforms. Lagos, in Nigeria, has patiently cultivated a tax-paying culture, with impressive results.

The lingering question, in Kampala and elsewhere, is who will bear the biggest burden. So far, at least, the wealthy properties on the city’s breezy hilltops have been relatively untouched by reform. “It’s much easier to go after the small guy,” says Nansozi Muwanga of Makerere University. “It’s much easier to after the taxi driver, the lady who brings her green peppers on the sidewalk, the person who’s selling Chinese clogs.”