The staff of the Uganda Revenue Authority (URA) have long been concerned that they do not have in place the procedures to ensure that the growing ranks of wealthy Ugandans pay their share of taxes. An approach to the ICTD enabled the URA to conduct a rigorous research study. The research revealed the scale of the problem and led to the creation of a special High Net Worth Individuals Unit. That unit has already brought in over £4 million in additional revenue in its first year of operation.

Like tax authorities in many developing countries, the Uganda Revenue Authority (URA) relies excessively on a small number of larger formal sector firms for its revenue. This is not good for business or investment. One reason is that the Authority does not have in place the organisation and procedures to effectively tax the growing number of rich Ugandans. URA had been concerned about this issue for years, but did not have all the necessary information to develop a targeted response. In early 2015, URA staff approached the ICTD with an outline research idea. The ICTD recruited Dr Jalia Kangave, a Ugandan academic tax lawyer, to help the URA develop a rigorous research proposal and to guide the research. Three URA staff undertook the research along with Dr Kangave.

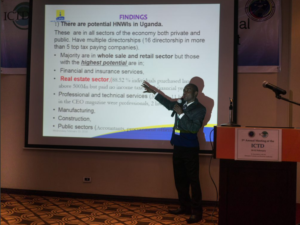

The research quickly revealed major loopholes in the tax system, and strong evidence of tax avoidance and evasion. In examining lawyers from top commercial firms, they found that out of 60, only 13 had paid personal income tax in 2013. They also found 12 people who had paid more than £14,000 in customs duties in 2014 without paying any income tax. Investigating a group of 71 high-ranking government officials owning large business assets (like hotels, schools and media houses), they found that only one had paid personal income tax between 2011 and 2014. Further, the companies the officials were associated with were largely non-compliant, with 47 out of 56 not paying any corporate income tax in 2013.

The results of the research were presented to the URA management, staff and were written up and made available publicly, as an ICTD Working Paper. Based on the findings, the URA management decided to establish a HNWI Unit with 5 staff members. In its first year of operation, the unit collected over £4 million in additional revenue by identifying and engaging with HNWIs, upgrading software systems to flag compliance issues (such as mismatches between customs and domestic tax information), and a greater focus on taxing property rental income.

For a research project that cost £16,092, DFID’s Chief Scientific Advisor praised this as “fastastic” value for money. DFID also highlighted the project as “high impact” in its Research Review.

Henry Saka, the Commissioner of Domestic Taxes at the URA, said, “…It is important to tax this group because the tax compliance behaviour of the rich has a great bearing on the integrity of the tax system as a whole. This was a good research project, and the management had to take action immediately.”

It is just as important that the experience of working on this project helped build research capacity within the URA. Ronald Waiswa was one of the people involved. He said: “Working on this project has been an eye-opener, and I have learnt a lot from the other senior researchers involved.”

As a next step, the ICTD will be supporting Ronald and colleagues to examine in more detail, how a few other African revenue authorities deal with High Net Worth Individuals, and to assess the implications for the URA.

The research has also stimulated debate on the extent to which HNWIs are taxed in Africa, with a blog called “Why African Governments Should Tax the Rich” that was republished by more than 20 media outlets across the continent and discussed on the radio.