After the introduction of a tax on mobile money transactions in 2022, mobile money agents in Cameroon have been experiencing a decline in their revenues amid fierce competition, a proliferation of fraud and scams, and liquidity management challenges.

Alphonse Noah and Ruth Tacneng

Agents play a crucial role in the distribution of mobile money services throughout Cameroon. They act as intermediaries between mobile money service providers and mobile money account holders, helping the latter in the registration process, and add credit and take money out of their accounts.

Their widely distributed presence is vital to achieving financial inclusion, especially in areas underserved by banks and other traditional financial service providers.

Our recent survey of mobile money agents in Cameroon, conducted 15 months after the introduction of a tax on mobile money transactions, revealed that they are struggling to increase revenue from the mobile money business amid fierce competition, a proliferation of fraud and scams, and liquidity management challenges.

Main challenges

We surveyed 807 agents active in Cameroon’s Centre Region, which includes the capital, Yaoundé.

- Agents in Yaoundé identified network outages as the primary challenge to their operations.

- Agents operating outside of Yaoundé, including in rural areas, mainly expressed concerns about fraud and scams.

- Meeting customer needs, managing liquidity, and addressing security concerns were flagged as significant day-to-day challenges.

- The presence of too many competitors and security issues were cited as their main concerns related to the business environment.

Mobile money tax affects agents and users

Following in the footsteps of several African countries, Cameroon introduced a 0.2 per cent tax on mobile money transfers and withdrawals, effective 1st January 2022.

Although the Cameroon government views the measure as a way to broaden its fiscal base and diversify its revenue sources, this tax has sparked concerns about its potential adverse effects on financial inclusion. The tax is expected to affect not only the people who use mobile money services but also the agents in this business.

An agent’s revenue is mainly derived from commissions earned on each transaction. They typically receive an average of 40–45 per cent of the commission, with the remaining 55–60 per cent being shared among the mobile network operator (MTN or Orange), partner banks, and the agent’s manager (the ‘superagent’).

Our survey results reveal that most agents perceive the new tax negatively, citing its detrimental effect on their customers and their mobile money business.

Moreover, more than half (nearly six out of ten agents) question the fairness and impartiality of the tax.

How does the mobile money tax affect agents’ performance?

- The mobile money tax increases transaction costs, which may reduce the demand for mobile money services and, hence, the number of transactions.

- Taxes may affect the viability of an agent’s business, particularly for those agents facing high operating costs and earning commissions just slightly above their break-even point. In this case, they need more transactions just to break even.

- The adverse impact of the mobile money tax may be greater in areas where agent competition is high.

- Agents may have to adopt specific business strategies to maintain their pre-tax revenue levels.

Agents’ fears of revenue decline supported by data

As well as using information from our survey results, we examined the commissions and transactions of thousands of agents in the Centre Region from the agent managers’ databases.

As described in our working paper titled Cameroon’s Tax on Mobile Money: Implications for Agents’ Performance and Revenue Sustainability, we find empirical evidence showing a decline in agents’ revenues after introducing the mobile money tax. This is particularly the case for agents operating in Yaoundé, the capital. Agents whose activities were potentially more exposed to the tax due to the regressive network fee structure experienced a larger decline in their commission. They are agents who conducted more and performed larger transactions before the tax, have been in the business for at least three years, are operating from local commercial areas rather than from road stands or kiosks.

How have agents reacted to the mobile money tax?

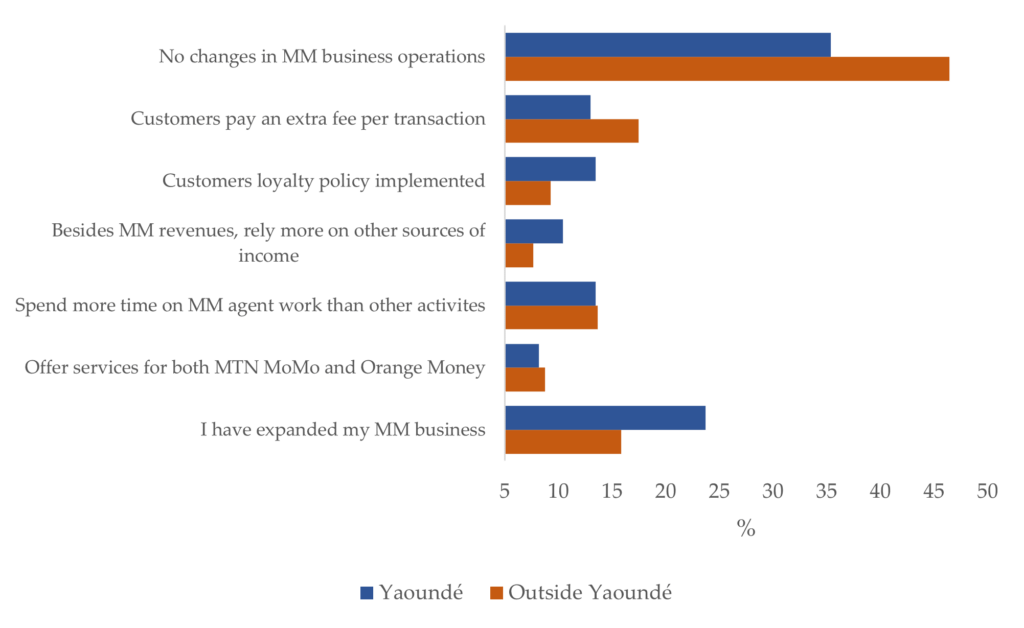

While the majority of surveyed active agents indicated that they have not changed how they conduct their business since the mobile money tax came into effect, in Yaoundé close to 25 per cent said they had expanded their mobile money business, mainly by raising capital. Outside Yaoundé, including in rural areas, about 17 per cent of agents were asking customers to pay an extra (non-regulatory) fee per transaction (see figure below).

Strategies implemented by mobile money (MM) agents since the tax came into effect in January 2022

Agents’ growth strategies

To grow their mobile money business in the short run, most agents in Yaoundé said they were increasing their liquidity capacities to meet demand.

The top priority for agents operating in peripheral communities outside Yaoundé is to improve communication and visibility.

Agents in both areas also mentioned attracting more clients as an alternative growth strategy.

Only a few active agents (8 per cent) indicated that they might quit the mobile money business in the medium term, seeing themselves working in the commerce, catering or agricultural sectors.

Why agents quit the mobile money business

We also surveyed 150 former mobile money agents in the Centre Region, 60 per cent of whom had ceased their operations after 2022.

The results reveal that the prospect of profitability is a critical determinant for getting into and out of the mobile money business.

While the majority (60 per cent) indicated that earning additional income was the main driver for their becoming an agent, not getting enough commissions was the most cited reason for agents ceasing their mobile money business.

They attributed the failure to generate enough commissions to:

- high operating expenses (21.95 %)

- too many competitors (19.55 %)

- a decline in transactions (19.55 %)

- the mobile money tax (17.07%).

Former agents also mentioned household shocks (such as accidents, sickness and death), scams and attacks as critical reasons for quitting the business.

They now work in grocery stores, boutiques, restaurants or bars, operate small-scale businesses, or are pursuing further studies.

Only 35 per cent of former agents were still contemplating returning to the mobile money business, while one in four was undecided.

Growing the mobile money business in Cameroon

Although it is too early to assess the long-term impact of the mobile money tax on agents’ business operations, our analyses indicate a decline in agents’ revenues months after the MM tax. Although a uniform tax rate of 0.2 per cent on mobile money transfers and withdrawals is applied, the regressive network fee structure implies that the additional financial burden faced by clients is higher the larger the transactions are. Thus, some agents faced a larger decline in their commissions after introducing the tax.

To the extent that earning potential is a strong determinant for agents getting in and out of the mobile money business, it is crucial for policymakers to evaluate the effect of taxes on all key actors in the mobile money ecosystem, including agents who play a significant role in driving financial inclusion.

Growth in the mobile money business in Cameroon can be further enhanced through increased collaboration and coordination between policymakers, mobile network operators, and other industry partners and stakeholders in order to:

- strengthen fraud and scam recourse mechanisms

- educate agents on improving their liquidity management

- improve network coverage and quality

- create an enabling environment for mobile money, including consumer protection