Despite being recognised as a critical aspect of tax compliance, taxpayer knowledge is a very under-explored topic. Using evidence from Rwanda and Eswatini, Giulia Mascagni explores why taxpayer education matters, whether it is effective, and how research can inform governments’ taxpayer education programmes.

Across Africa, many taxpayers have a shockingly poor understanding of the tax system.

We recently conducted a survey of new taxpayers in Rwanda with basic questions about the tax system, and the average respondent got less than a third of them correct. Other surveys in Rwanda and recent evidence from Eswatini give consistent results. These figures confirm what recent cross-country surveys already suggested: the majority of citizens in Africa do not know what taxes they owe to the government or what tax payments are for.

Tax knowledge includes a range of aspects, from the practicalities of how to file a tax return, through to an understanding of the links between tax and public spending. It also includes knowledge of different tax types, how they are collected, taxpayers’ rights, and how to navigate any appeal system.

Why does poor taxpayer knowledge matter?

A lack of taxpayer knowledge is a problem for governments for two main reasons:

- Tax compliance

There is now solid evidence that lack of taxpayer knowledge leads to low levels of tax compliance. When taxpayers don’t understand the tax system, they are likely to get confused, spend more time figuring out their obligations, and make mistakes that could lead to sanctions. The costs of compliance (taxpayer’s cognitive, time and financial costs as they grapple to understand and comply with the system) are proven to be large and highly regressive. Small taxpayers bear the largest burden. Sometimes compliance costs mean that taxpayers actually end up paying more tax than they should. This creates frustration and perceptions of unfairness, which in turn negatively affect compliance. - Trust and accountability

What’s more, poor knowledge might prevent taxpayers from engaging in debates around tax. This weakens the vital role that tax can play in strengthening accountability and governance. Forthcoming evidence from Ghana and Sierra Leone suggests that taxpayers would feel less vulnerable to corruption and inappropriate behaviour by tax officials if they knew more about their tax obligations. Addressing even the most practical aspects of taxpayer knowledge might reduce corruption, strengthen trust, and improve accountability.

How are governments addressing poor taxpayer knowledge?

Given the importance of helping businesses understand the tax system, it is unsurprising that revenue administrations across the world are engaged in a huge range of initiatives to educate taxpayers.

In Africa alone, our review of taxpayer education initiatives found activities from school-based tax clubs and mobile tax units in rural areas, through to radio programmes, songs, social media videos and even tax-themed soap operas. Similar initiatives are found globally, with examples from the USA, Brazil, Chile, Colombia, Estonia, Jamaica, Mexico, Malaysia and Morocco.

With governments investing significant resources in taxpayer education programmes, it’s perhaps surprising that they remain largely undocumented. Until recently, none of these initiatives had ever been evaluated to see whether it works.

What evidence is there that taxpayer education works?

Although taxpayer education is extremely under-researched, new evidence demonstrates the link between tax knowledge and compliance.

Last year we published the first rigorous evaluation of the impact of a taxpayer education programme: the Rwanda Revenue Authority’s (RRA) annual half-day taxpayer training course, for all newly registered businesses.

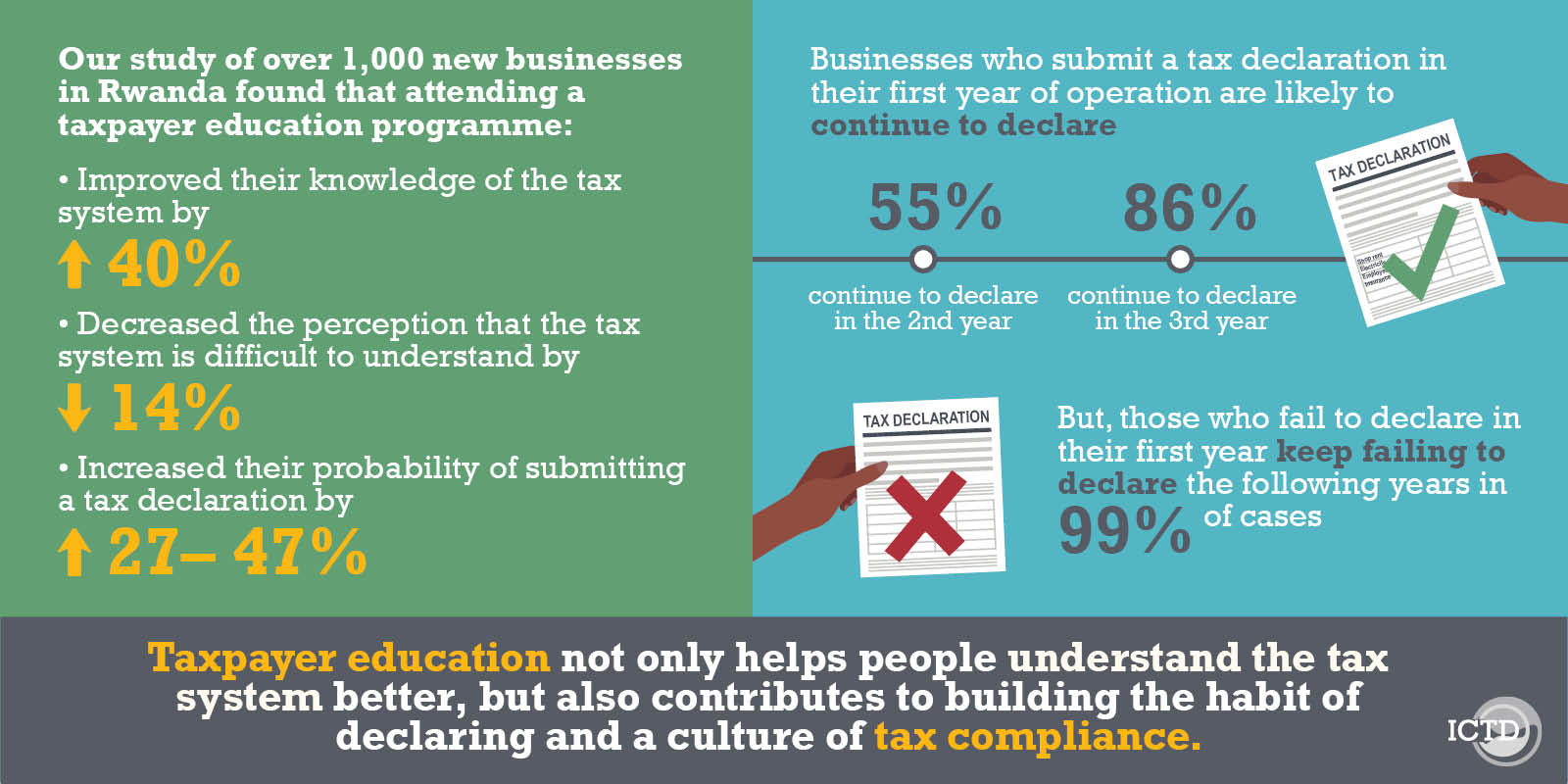

Our research found that while tax knowledge was initially very low, attending the training session substantially improved taxpayers’ knowledge of the tax system (a 40% increase) and also reduced their perceptions about the system’s complexity (a 14% decrease).

Crucially, attending the training session increases the probability that a business will file a tax declaration by about 30%. This is particularly significant in the context of very low declaration rates (around 46%) amongst new taxpayers in Rwanda. Importantly, whether new taxpayers file at first affects their future compliance – those who fail to file in the first year are very unlikely to ever file in subsequent years.

So not only did the study show that taxpayer education plays a crucial role in building the habit of tax declaration, it also has the potential to lead to sustained revenue gains over time.

These results do not seem specific to Rwanda. Although there is very little evidence from elsewhere, recent survey evidence from Eswatini points in the same direction, confirming that tax knowledge is highly correlated with compliance behaviour.

How is the Covid-19 pandemic impacting taxpayer education?

The current global health crisis presents an immediate need for governments to communicate effectively with taxpayers. Taxpayer education and facilitation of compliance are more important than ever.

Many revenue authorities have responded to the crisis by delaying deadlines, suspending payments, and providing other taxpayer support. It’s critical that these measures are communicated clearly, to increase awareness and take-up. An ongoing ICTD project is looking into the implications of the pandemic on tax burdens, taxpayer attitudes, and the reach of tax relief.

What’s more, Covid-19 is putting further pressure on governments to make it as easy as possible for businesses to comply with regulations. With less face-to-face support and advice available to confused taxpayers, governments will increasingly need to use online channels and build on their current mass and social media campaigns.

How can research help inform effective taxpayer education?

Without understanding which education initiatives work – and which don’t – governments risk spreading scarce resources too thinly and investing in ineffective initiatives.

More research is needed to help fill this evidence gap. Rigorous evaluations of existing programmes can help governments focus on the initiatives that are working best, and find ways to adapt those that need improvement.

For example, our recent surveys in Rwanda and Eswatini explored how taxpayers prefer to communicate with the revenue authority. In both cases we found scope for the tax administrations to improve their communication, and we identified the best channels and initiatives through which they should target resources.

Beyond education and communication, research could also help answer broader questions:

- What is the role of weak taxpayer knowledge in shaping trust in institutions and political engagement?

- To what extent can increased knowledge empower taxpayers to fight corruption and affirm their rights?

- How do different types of tax knowledge influence compliance?

While much is unknown, what is clear is that more research and policy dialogue on taxpayer education is urgently needed – across Africa and beyond.

Learn more:

Read our review of taxpayer education in Africa, including key challenges and recommendations, or see the 2-page brief version here.

Read more about the evaluation of the Rwandan programme in the paper “Teach to Comply?” or see the 2-page brief here.

Explore the ICTD’s work on tax administration and compliance.

Thanks to Sarah Nelson for her support in editing this piece.