The use of tax treaties by developing countries is controversial, to say the least. Best case scenario? Tax treaties help to attract foreign direct investment by reducing the risk of double taxation. Evidence for this is weak. Worst case scenario? They become a vehicle for multinational tax avoidance leading to huge revenue losses for developing countries.

Despite the uncertain benefits and widely-recognised risks, developing countries continue to sign tax treaties. In such cases, an understanding of good treaty practice – how countries in a similar position have negotiated, reviewed, or modified their treaties to better protect their tax base – can help lay the foundations for fairer and more sustainable tax treaties.

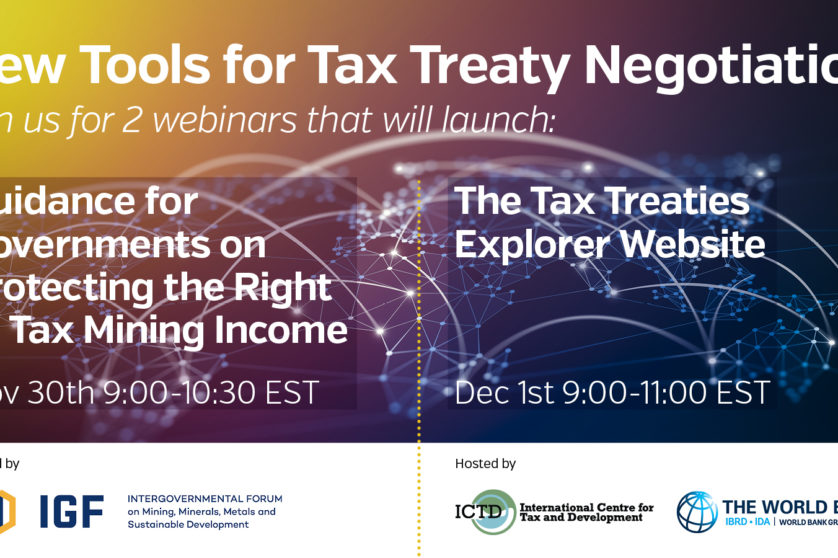

We are pleased to announce two webinars on tax treaty practice, which will launch two new tools:

- A new practice note “Protecting the Right to Tax Mining Income: Tax Treaty Practice in Resource-Rich Countries” (draft available here), hosted by the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF).

- The Tax Treaties Explorer, an interactive data visualisation website created by the International Centre for Tax and Development (ICTD) with support from the World Bank’s Global Tax Program.

Join us for these webinars, and finish 2021 with a deep dive into ground-breaking research and practical guidance on tax treaty practice in developing countries!

Both webinars will include simultaneous interpretation for participants in English, French, and Spanish.

Webinar 1 | Protecting the Right to Tax Mining Income: Tax Treaty Practice in Resource-rich Countries

Tuesday November 30th 09:00-10.30 EST (14:00-15:30 GMT)

Mining involves finite, non-renewable resources. Countries that host such resources only get one chance to tax the income arising from their extraction. This fact, and the prevalence of investment from foreign multinationals, makes the impact of tax treaties on mining revenue collection of critical importance to resource-rich developing countries.

IGF’s new practice note aims to equip governments of resource-rich developing countries to decide if tax treaties are necessary and, if they are, to design them in a way that safeguards their right to tax mining income at all stages of the mining value chain.

Moderator:

- Michael Lennard, Chief of International Tax Cooperation and Trade, Financing for Development Office, United Nations

Speakers:

- Amadou Abdoulaye Badiane, Director of Legislation and International Cooperation, Directorate General of Taxes and Customs, Senegal

- Carlos Protto, Director of International Tax Relations, Ministry of Treasury, Argentina

- Alexandra Readhead, Lead, Tax and Extractives, IGF

- Tugsjargal Sereenendorj, Head of Large Taxpayers Office, General Department of Taxation, Mongolia

- Jaqueline Taquiri, Policy Advisor, Tax and Extractives, IGF

See the presentation slides here and watch the video recording below.

Webinar 2 | The Tax Treaties Explorer: New Data for Better Negotiation

Wednesday December 1st 09:00-11:00 EST (14:00-16:00 GMT)

The new Tax Treaties Explorer website provides a means to compare and contrast tax treaties in ways that complement analysis of the legal wording. It is based on a new dataset of almost every treaty signed by developing economies. For non-specialist policymakers and others with a stake in tax policy, this is an accessible entry point to understand treaties in comparative context.

This event, jointly hosted by the ICTD and the Global Tax Program of the World Bank, will introduce the Tax Treaties Explorer and demonstrate how it can be used by practitioners and researchers. It will feature a brief presentation of the Toolkit on Tax Treaty Negotiations from the Platform for Collaboration on Tax, as well as presentations of three research studies that use the new Explorer data to compare and contrast treaties and study their effects:

- Tax Treaties and Foreign Direct Investment Flows: A Replication Study by Martin Hearson, Marco Carreras, and Anna Custers

- Tax Treaty Aggressiveness: Who is Undermining Taxing Rights in Africa? by Markus Meinzer, Maimouna Diakité, Lucas Millán Narotzky, and Mirsolav Palansky

- Taxing Profits from International Maritime Shipping in Africa: Past, Present and Future of UN Model Article 8 (Alternative B) by Tatiana Falcão and Bob Michel